Content

The proportion of fixed versus variable costs that a company incurs (and how they’re allocated) can depend on its industry. Since fixed costs are not traceable and common fixed costs related to a company’s production of any goods or services, they are generally indirect. Shutdown points tend to be applied to reduce fixed costs.

- An investment center is a profit center for which management is able to measure objectively the cost of assets used in the center’s operations.

- Fixed cost refers to the cost of a business expense that doesn’t change even with an increase or decrease in the number of goods and services produced or sold.

- Instead, changes can stem from new contractual agreements or schedules.

- Management, investors, shareholders, financiers, government, and regulatory agencies rely on financial reports for decision-making.

- Define a standard cost and explain what constitutes the components of a standard cost.

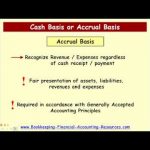

Generally Accepted Accounting PrinciplesGAAP are standardized guidelines for accounting and financial reporting. An operating expense is an expenditure that a business incurs as a result of performing its normal business operations. Break-even analysis calculates a margin of safety where an asset price, or a firm’s revenues, can fall and still stay above the break-even point.

Document Information

Reporting FinancialsFinancial reporting is a systematic process of recording and representing a company’s financial data. The reports reflect a firm’s financial health and performance in a given period. Management, investors, shareholders, financiers, government, and regulatory agencies rely on financial reports for decision-making. Manufacturing cost is the total cost of procuring or producing a product.

Since sales revenue and variable costs are typically driven by units sold these items can be easily traced to a particular segment. For example, it is easy to determine if a sale was a social media game or a cell phone game. Media Masters recently launched a series of successful social media games causing a spike in customer subscriptions and sales revenue.

Featured Businesses

Product Line refers to the collection of related products that are marketed under a single brand, which may be the flagship brand for the concerned company. Ceat Tyre Inc. manufactures automotive tyres. It has two departments, retail and wholesale. Below are the cost and revenue of each department. Or revenue are 10 percent or more of the total companies’ profit or assets. Companies can produce more profit per additional unit produced with higher operating leverage.

The most recent quarterly contribution margin income statement is presented below. Explain the difference between fixed costs and variable costs. Common Fixed cost is the fixed cost that supports the business activities of the two or more business segments. It is very hard to separate the cost from each segment or unit. It is the cost that is paid in total to cover all cost objectives in different business units, locations,s and so on.

What is Segment Margin?

The wholesale department can improve the profits by closing the LMT department. Business expenses are costs incurred in the ordinary course of business. Business expenses are tax-deductible and are always netted against business income. Fixed costs can be used to calculate key metrics, including the breakeven analysis or a company’s operating leverage. Fixed costs are expenses that a company must pay outside of its specific business activities.

- While preparing segmented income statements the fixed cost is divided into two parts one is traceable fixed cost and other is common fixed cost.

- Because a direct cost is traceable to a cost object, the cost is likely to be eliminated if the cost object is eliminated.

- Explain the difference between absorption costing and variable costing.

- For common fixed costs, the company or project maintains these costs.

What are traceable and common costs?

A traceable cost is a cost that can be directly attributed or traced to the products being produced. Examples of traceable costs are direct materials cost, and direct labor cost. A common cost is a cost that is incurred by an entire factory and hence, cannot be directly attributed to different products.